The UK is Europe’s top-performing advertising spend market and the fourth largest in the world, with the advertising spend forecast to decline by 16.7% by the end of 2020, mainly due to the impact of COVID-19. Client budget cuts are one of the most significant impacts of COVID-19 affecting revenue streams in the UK marketing and advertising agencies

' market. Some top trends to navigate the pandemic's impact that have emerged from recent surveys on advertising agencies include flexibility in contract terms to customers and outsourcing activities.

GENERAL HEALTH

Market Landscape

- The UK is Europe’s top-performing advertising spend market and the fourth largest in the world, after the US, China and Japan. Apart from a slight decrease in 2017 due to economic concerns from businesses, arising from the EU referendum, the advertising market in the UK has registered consistent year-on-year growth since 2009.

- Digitalization has been the key driver behind the recent significant changes in advertising formats, with online display, video on demand, online radio, and search engines advertising platforms registering the most significant growths in 2018, while traditional advertising print platforms, such as mail, magazines, and newspapers experienced declines.

- With a market size of $32.75 billion (£25 billion), the advertising agency industry boasts number of businesses amounting to 16,560 and industry employment amounting to 109,200.

- Digital media holds the largest share of advertising spend in the UK compared to traditional media, making up around 70% of total ad spend, with search advertising as its largest segment.

- Among digital platforms, advertising spending in the UK is highest in digital advertising, followed by mobile and social media advertising. On the other hand, the highest advertising spend in traditional media is in television, followed by direct mail, radio, and magazine.

Market Forecast

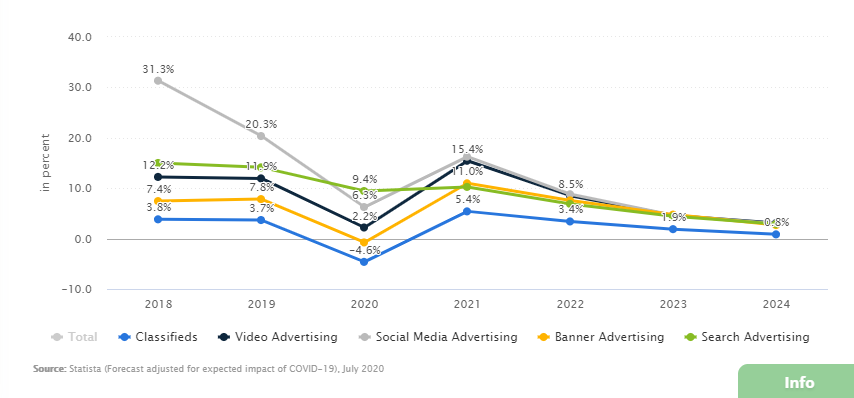

- The digital advertising market in the UK is expected to show an 11.8% growth in 2021, with social media advertising leading the growth, followed by video and banner advertising.

- The graph below illustrates the digital ad spending development and forecast between 2018-2024 for various segments.

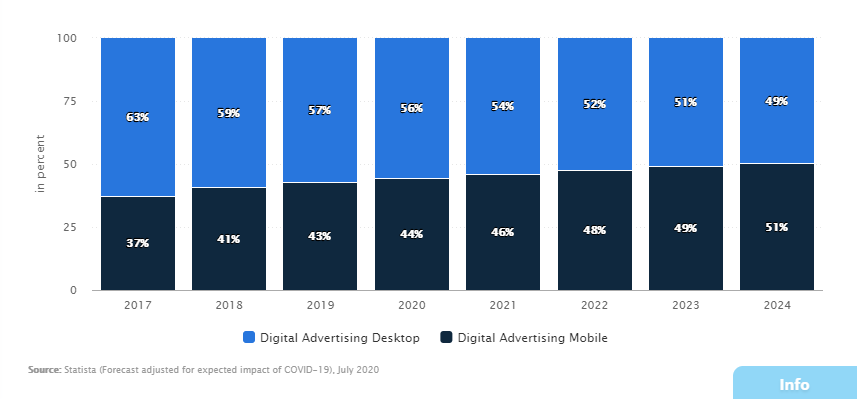

- The digital advertising market generated through mobile has been showing steady growth through the years, rising from 37% of total digital advertising in 2017 to 46% in 2020. Additionally, mobile advertising is forecast to make up 51% of total ad spending in 2024.

- The graph below illustrates the split and forecast ad spending between desktop and mobile advertising in the UK for the 2017-2024 period.

Programmatic advertising is forecast to generate 86% of the UK digital advertising revenue in 2024, indicating steady growth from 79% in 2017 to 84% in 2020.

Programmatic advertising is forecast to generate 86% of the UK digital advertising revenue in 2024, indicating steady growth from 79% in 2017 to 84% in 2020.- The graph below illustrates the split and forecast share of programmatic and non-programmatic advertising for the 2017-2024 period.

COVID-19 IMPACT

Budget Cuts and Revenue Loss

- The UK advertising spend is forecast to decline by 16.7% by the end of 2020, with COVID-19 ending 10 years of steady growth in the industry.

- However, the spend is expected to return to growth with a 13.6% rise in 2021, which is forecast to be lower than 2019.

- Traditional media is forecast to decline more sharply than digital media, accounting for a 7.5% drop in the total ad spend.

- Advertising companies have adopted cost-saving measures, including pay cuts. Publicis, for instance, announced plans to cut management pay and halve its dividends, saving costs of up to $545 million. Although the company recorded a 17.1% increase in net revenue to $3.2 billion (€2.5 billion) in the first quarter of 2020, Publicis recorded a 2.9% decrease in organic growth, mainly attributed to the impact of Covid-19.

- On the other hand, WPP recorded a 15% fall in shares following a slowdown in business operations. Additionally, the company received access to $747 million (£600 million) in UK government loans under its Covid Corporate Financing Facility. Interpublic Group (IPG) also withdrew its 2020 full-year financial performance targets, citing uncertainty from the COVID-19 impact.

- FMCG companies, which account for the largest portion of revenues for advertising companies have cut their advertising budgets, with the initially planned marketing campaigns being reviewed and scaled back.

Agencies' Views and Expectations

- According to a survey carried out by Ad World Masters on 55 countries, with the UK making up 13.1% of the advertising agencies, 47.8% do not intend to reduce their team size while 12.4% and 4% are considering it and planning it, respectively.

- According to the survey, bigger agencies with higher annual income have a higher likelihood of reducing their workforce compared to mid-sized or smaller agencies.

- The main departments up for reduction for the agencies considering it include administration (25.4%), client service (17.2%), management (14.9%), and art direction (14.2%).

- The graph below illustrates the areas of planned or possible workforce reduction in advertising agencies in 2020.

- According to Ciaran Connolly, the CEO of ProfileTree, one of the UK agencies that participated in the survey, the biggest impact of COVID-19 on advertising agencies in the UK has been on cash flow, where “some clients cannot pay, others are looking for long payment terms, while others are seeking to pause work until they can see the way forward.”

COVID-19 RESPONSE

Increasing flexibility

- According to a survey carried out by Uplers, 58% of the surveyed advertising agencies were offering flexibility in contract terms to customers, with 28% offering reduced fees. According to the survey, 33% of the companies offering the highest price reductions are located in the UK and Europe.

- The key driver behind this approach is the decline in client revenue streams, with advertising companies seeking to retain their customers. According to Nickolas Rekeda, CMO of MGID, "43% of consumers find it reassuring to hear from brands they know and trust. This means that instead of stopping marketing activity altogether, the industry must adapt its strategies to maintain customer loyalty during the pandemic, and beyond."

- The survey indicated that agencies with an employee size of 25-100 offered the most flexibility to clients terms and conditions, compared to agencies with a greater or lesser employee size.

Outsourcing

- According to SmartBrief, outsourcing is one of the most definitive trends that emerged from Uplers' survey. A full 80% of the advertising agencies surveyed indicated that they would increase, maintain, or explore outsourcing activities.

- The key driver behind this trend is the agencies' need for the ability to scale up and be agile relative to demand, especially in a crisis similar to the pandemic's impact, therefore, offering better security during unprecedented times.

- The survey showed that 80% of the agencies that recorded more than 30% revenue growth indicated outsourced jobs, with an additional 24% indicating that they were going to increase or explore outsourcing activities.

- According to True Media CEO Jack Miller, “outsourcing media helps agencies run more profitably and provides clients with deeper resources."